CompositeCurve#

- class rateslib.curves.CompositeCurve(curves, id=NoInput.blank)#

Bases:

CurveA dynamic composition of a sequence of other curves.

Note

Can only composite curves of the same type:

CurveorLineCurve. Other curve parameters such asmodifier,calendarandconventionmust also match.- Parameters:

Examples

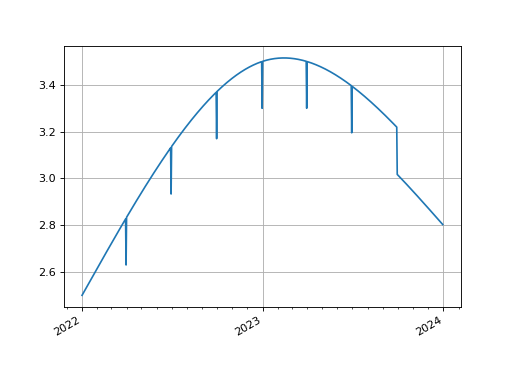

Composite two

LineCurves. Here, simulating the effect of adding quarter-end turns to a cubic spline interpolator, which is otherwise difficult to mathematically derive.In [1]: from rateslib.curves import LineCurve, CompositeCurve In [2]: line_curve1 = LineCurve( ...: nodes={ ...: dt(2022, 1, 1): 2.5, ...: dt(2023, 1, 1): 3.5, ...: dt(2024, 1, 1): 3.0, ...: }, ...: t=[dt(2022, 1, 1), dt(2022, 1, 1), dt(2022, 1, 1), dt(2022, 1, 1), ...: dt(2023, 1, 1), ...: dt(2024, 1, 1), dt(2024, 1, 1), dt(2024, 1, 1), dt(2024, 1, 1)], ...: ) ...: In [3]: line_curve2 = LineCurve( ...: nodes={ ...: dt(2022, 1, 1): 0, ...: dt(2022, 3, 31): -0.2, ...: dt(2022, 4, 1): 0, ...: dt(2022, 6, 30): -0.2, ...: dt(2022, 7, 1): 0, ...: dt(2022, 9, 30): -0.2, ...: dt(2022, 10, 1): 0, ...: dt(2022, 12, 31): -0.2, ...: dt(2023, 1, 1): 0, ...: dt(2023, 3, 31): -0.2, ...: dt(2023, 4, 1): 0, ...: dt(2023, 6, 30): -0.2, ...: dt(2023, 7, 1): 0, ...: dt(2023, 9, 30): -0.2, ...: }, ...: interpolation="flat_forward", ...: ) ...: In [4]: curve = CompositeCurve([line_curve1, line_curve2]) In [5]: curve.plot("1d") Out[5]: (<Figure size 640x480 with 1 Axes>, <Axes: >, [<matplotlib.lines.Line2D at 0x112195310>])

(

Source code,png,hires.png,pdf)

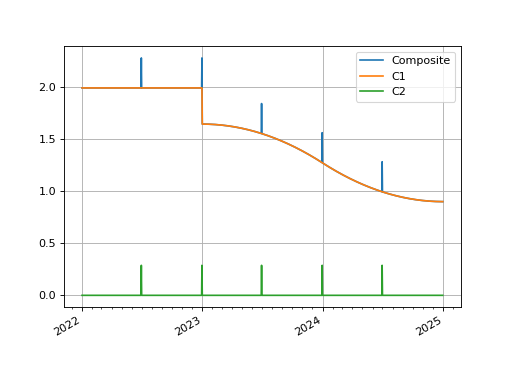

We can also composite DF based curves by using a fast approximation or an exact match.

In [6]: from rateslib.curves import Curve, CompositeCurve In [7]: curve1 = Curve( ...: nodes={ ...: dt(2022, 1, 1): 1.0, ...: dt(2023, 1, 1): 0.98, ...: dt(2024, 1, 1): 0.965, ...: dt(2025, 1, 1): 0.955 ...: }, ...: t=[dt(2023, 1, 1), dt(2023, 1, 1), dt(2023, 1, 1), dt(2023, 1, 1), ...: dt(2024, 1, 1), ...: dt(2025, 1, 1), dt(2025, 1, 1), dt(2025, 1, 1), dt(2025, 1, 1)], ...: ) ...: In [8]: curve2 =Curve( ...: nodes={ ...: dt(2022, 1, 1): 1.0, ...: dt(2022, 6, 30): 1.0, ...: dt(2022, 7, 1): 0.999992, ...: dt(2022, 12, 31): 0.999992, ...: dt(2023, 1, 1): 0.999984, ...: dt(2023, 6, 30): 0.999984, ...: dt(2023, 7, 1): 0.999976, ...: dt(2023, 12, 31): 0.999976, ...: dt(2024, 1, 1): 0.999968, ...: dt(2024, 6, 30): 0.999968, ...: dt(2024, 7, 1): 0.999960, ...: dt(2025, 1, 1): 0.999960, ...: }, ...: ) ...: In [9]: curve = CompositeCurve([curve1, curve2]) In [10]: curve.plot("1D", comparators=[curve1, curve2], labels=["Composite", "C1", "C2"]) Out[10]: (<Figure size 640x480 with 1 Axes>, <Axes: >, [<matplotlib.lines.Line2D at 0x1128fa710>, <matplotlib.lines.Line2D at 0x1128fa850>, <matplotlib.lines.Line2D at 0x1128fa990>])

(

Source code,png,hires.png,pdf)

The

rate()method of aCompositeCurvecomposed ofCurves accepts anapproximateargument. When True by default it used a geometric mean approximation to determine composite period rates. Below we demonstrate this is more than 1000x faster and within 1e-8 of the true value.In [11]: curve.rate(dt(2022, 6, 1), "1y") Out[11]: 1.859031948251767 In [12]: %timeit curve.rate(dt(2022, 6, 1), "1y") 32.2 us +- 4.84 us per loop (mean +- std. dev. of 7 runs, 10,000 loops each)

In [13]: curve.rate(dt(2022, 6, 1), "1y", approximate=False) Out[13]: 1.8590319414411982 In [14]: %timeit curve.rate(dt(2022, 6, 1), "1y", approximate=False) 19.4 ms +- 2.43 ms per loop (mean +- std. dev. of 7 runs, 10 loops each)

Attributes Summary

Methods Summary

copy(*args, **kwargs)Not implemented on CompositeCurve types.

csolve(*args, **kwargs)Not implemented on CompositeCurve types.

from_json(*args, **kwargs)Not implemented on CompositeCurve types.

index_value(date[, interpolation])Calculate the accrued value of the index from the

index_base, which is taken asindex_baseof the first composited curve given.plot(tenor[, right, left, comparators, ...])Plot given forward tenor rates from the curve.

plot_index([right, left, comparators, ...])Plot given forward tenor rates from the curve.

rate(effective[, termination, modifier, ...])Calculate the composited rate on the curve.

roll(tenor)Create a new curve with its shape translated in time

shift(spread[, id, composite, collateral])Create a new curve by vertically adjusting the curve by a set number of basis points.

to_json(*args, **kwargs)Not implemented on CompositeCurve types.

translate(start[, t])Create a new curve with an initial node date moved forward keeping all else constant.

update(*args, **kwargs)Not implemented on CompositeCurve types.

update_node(*args, **kwargs)Not implemented on CompositeCurve types.

Attributes Documentation

- ad#

- collateral = None#

Methods Documentation

- copy(*args, **kwargs)#

Not implemented on CompositeCurve types.

- csolve(*args, **kwargs)#

Not implemented on CompositeCurve types.

- from_json(*args, **kwargs)#

Not implemented on CompositeCurve types.

- index_value(date, interpolation='daily')#

Calculate the accrued value of the index from the

index_base, which is taken asindex_baseof the first composited curve given.

- plot(tenor, right=NoInput.blank, left=NoInput.blank, comparators=NoInput.blank, difference=False, labels=NoInput.blank)#

Plot given forward tenor rates from the curve. See notes.

- Parameters:

tenor (str) – The tenor of the forward rates to plot, e.g. “1D”, “3M”.

right (datetime or str, optional) – The right bound of the graph. If given as str should be a tenor format defining a point measured from the initial node date of the curve. Defaults to the final node of the curve minus the

tenor.left (datetime or str, optional) – The left bound of the graph. If given as str should be a tenor format defining a point measured from the initial node date of the curve. Defaults to the initial node of the curve.

comparators (list[Curve]) – A list of curves which to include on the same plot as comparators.

difference (bool) – Whether to plot as comparator minus base curve or outright curve levels in plot. Default is False.

labels (list[str]) – A list of strings associated with the plot and comparators. Must be same length as number of plots.

- Returns:

(fig, ax, line)

- Return type:

Matplotlib.Figure, Matplotplib.Axes, Matplotlib.Lines2D

Notes

This function plots single-period, simple interest curve rates, which are defined as:

\[1 + r d = \frac{v_{start}}{v_{end}}\]where d is the day count fraction determined using the

conventionassociated with the Curve.This function does not plot swap rates, which is impossible since the Curve object contains no information regarding the parameters of the ‘swap’ (e.g. its frequency or its convention etc.). If

tenorslonger than one year are sought results may start to deviate from those one might expect. See Issue 246.

- plot_index(right=NoInput.blank, left=NoInput.blank, comparators=NoInput.blank, difference=False, labels=NoInput.blank)#

Plot given forward tenor rates from the curve.

- Parameters:

tenor (str) – The tenor of the forward rates to plot, e.g. “1D”, “3M”.

right (datetime or str, optional) – The right bound of the graph. If given as str should be a tenor format defining a point measured from the initial node date of the curve. Defaults to the final node of the curve minus the

tenor.left (datetime or str, optional) – The left bound of the graph. If given as str should be a tenor format defining a point measured from the initial node date of the curve. Defaults to the initial node of the curve.

comparators (list[Curve]) – A list of curves which to include on the same plot as comparators.

difference (bool) – Whether to plot as comparator minus base curve or outright curve levels in plot. Default is False.

labels (list[str]) – A list of strings associated with the plot and comparators. Must be same length as number of plots.

- Returns:

(fig, ax, line)

- Return type:

Matplotlib.Figure, Matplotplib.Axes, Matplotlib.Lines2D

- rate(effective, termination=NoInput.blank, modifier=NoInput.inherit, approximate=True)#

Calculate the composited rate on the curve.

If rates are sought for dates prior to the initial node of the curve None will be returned.

- Parameters:

effective (datetime) – The start date of the period for which to calculate the rate.

termination (datetime or str) – The end date of the period for which to calculate the rate.

modifier (str, optional) – The day rule if determining the termination from tenor. If False is determined from the Curve modifier.

approximate (bool, optional) – When compositing

Curves, calculating many individual rates is expensive. This uses an approximation typically with error less than 1/100th of basis point. Not used ifmulti_csais True.

- Return type:

- roll(tenor)#

Create a new curve with its shape translated in time

This curve adjustment is a simulation of a future state of the market where forward rates are assumed to have moved so that the present day’s curve shape is reflected in the future (or the past). This is often used in trade strategy analysis.

- Parameters:

tenor (datetime or str) – The date or tenor by which to roll the curve. If a tenor, as str, will derive the datetime as measured from the initial node date. If supplying a negative tenor, or a past datetime, there is a limit to how far back the curve can be rolled - it will first roll backwards and then attempt to

translate()forward to maintain the initial node date.- Return type:

- shift(spread, id=NoInput.blank, composite=True, collateral=NoInput.blank)#

Create a new curve by vertically adjusting the curve by a set number of basis points.

This curve adjustment preserves the shape of the curve but moves it up or down as a translation. This method is suitable as a way to assess value changes of instruments when a parallel move higher or lower in yields is predicted.

- Parameters:

spread (float, Dual, Dual2) – The number of basis points added to the existing curve.

id (str, optional) – Set the id of the returned curve.

composite (bool, optional) – If True will return a CompositeCurve that adds a flat curve to the existing curve. This results in slower calculations but the curve will maintain a dynamic association with the underlying curve and will change if the underlying curve changes.

collateral (str, optional) – Designate a collateral tag for the curve which is used by other methods.

- Return type:

- to_json(*args, **kwargs)#

Not implemented on CompositeCurve types.

- translate(start, t=False)#

Create a new curve with an initial node date moved forward keeping all else constant.

This curve adjustment preserves forward curve expectations as time evolves. This method is suitable as a way to create a subsequent opening curve from a previous day’s closing curve.

- Parameters:

start (datetime) – The new initial node date for the curve, must be in the domain: (node_date[0], node_date[1]]

t (bool) – Set to True if the initial knots of the knot sequence should be translated forward.

- Return type:

- update(*args, **kwargs)#

Not implemented on CompositeCurve types.

- update_node(*args, **kwargs)#

Not implemented on CompositeCurve types.