Pricing Mechanisms#

This guide is aimed at users who are not completely new to rateslib and who have experience already building Instruments, Curves and Solvers and are familiar with some of its mechanics already.

Summary#

Rateslib’s API design for valuing and obtaining risk sensitivities of Instruments follows the first two pillars of its design philosophy:

Maximise flexibility : minimise user input,

Prioritise risk sensitivities above valuation.

This means the arguments required for the

Instrument.npv(),

Instrument.delta() and

Instrument.gamma()

are the same and optionally require:

curves, solver, fx, base, local, (and vol for volatility products)

When calculating risk metrics a solver, which contains derivative mapping information, is

required. However, when calculating only value, it is sufficient to just provide curves

(and vol). In this

case, and if the curves do not contain AD then the calculation might be upto 300% faster.

Since these arguments are optional and can be inferred from each other it is important to understand the combination that can produce results. There are two sections on this page which discuss these combinations.

What is

baseandlocal? I.e. what currency will results be displayed in?How

curves,volandsolverand Instruments interact? I.e. which Curves and Vol objects will be used to price which Instruments?

What is base and local?#

One of the most important aspects to keep track of when valuing

Instrument.npv() is that

of the currency in which it is displayed. This is the base

currency it is displayed in. base does not need to

be explicitly set to get the results one expects.

The local argument

local can, at any time, be set to True and this will return a dict

containing a currency key and a value. By using this we keep track

of the currency of each Leg of the Instrument. This is important for

risk sensitivities and is used internally, especially for multi-currency instruments.

In [1]: curve = Curve({dt(2022, 1, 1): 1.0, dt(2023, 1, 1): 0.96}, id="curve")

In [2]: fxr = FXRates({"usdeur": 0.9, "gbpusd": 1.25}, base="gbp", settlement=dt(2022, 1, 3))

In [3]: fxf = FXForwards(

...: fx_rates=fxr,

...: fx_curves={"usdusd": curve, "eureur": curve, "gbpgbp": curve, "eurusd": curve, "gbpusd": curve},

...: base="eur",

...: )

...:

In [4]: solver = Solver(

...: curves=[curve],

...: instruments=[IRS(dt(2022, 1, 1), "1y", "a", curves=curve)],

...: s=[4.109589041095898],

...: fx=fxf,

...: )

...:

SUCCESS: `func_tol` reached after 0 iterations (levenberg_marquardt), `f_val`: 7.888609052210118e-31, `time`: 0.0002s

The below shows the use of the local argument to get the PV of both Legs on this XCS

separately in each currency.

When specifying a base and setting local to False the PV of the Legs are aggregated

and converted to the given currency.

In [5]: non_mtm_xcs = XCS(dt(2022, 2, 1), "6M", "A", currency="eur", pair="eurusd", leg2_mtm=False)

In [6]: non_mtm_xcs.npv(curves=[curve]*4, fx=fxf, local=True)

Out[6]:

{'eur': <Dual: 4.466513, (curve1, curve0), [-226.4, 221.8]>,

'usd': <Dual: -4.962793, (curve1, curve0, fx_usdeur), [251.5, -246.4, 5.5]>}

In [7]: non_mtm_xcs.npv(curves=[curve]*4, fx=fxf, base="usd")

Out[7]: <Dual: 0.000000, (curve1, curve0, fx_usdeur), [0.0, -0.0, 0.0]>

Defaulting to a Settlement Currency

When no base is provided something must be used as a default. All Periods and Legs

maintain their own _SettlementParams which specify the

settlement currency. However, multi-currency Instruments may contain multiple Legs with

different settlement currencies. In these cases the first Leg takes priority and all values

are converted to the settlement currency of that Leg. For the above XCS this

happens to be EUR, so an unspecified npv() method will yield a value in EUR.

In [8]: non_mtm_xcs.npv(curves=[curve]*4, fx=fxf)

Out[8]: <Dual: 0.000000, (curve1, curve0, fx_usdeur), [0.0, -0.0, 0.0]>

What is best practice?#

For single currency Instruments, if you want to return an npv value in its local currency

then you do not need to supply base or fx arguments. However, to

be explicit, base can also be specified.

In [9]: irs = IRS(dt(2022, 2, 1), "6M", "A", currency="usd", fixed_rate=4.0, curves=curve)

In [10]: irs.npv(solver=solver) # USD is local currency default, solver.fx.base is EUR.

Out[10]: <Dual: 330.405115, (curve1, curve0), [-514447.8, 494200.3]>

In [11]: irs.npv(solver=solver, base="usd") # USD is explicit, solver.fx.base is EUR.

Out[11]: <Dual: 330.405115, (curve1, curve0), [-514447.8, 494200.3]>

To calculate a value in another non-local currency supply an fx object and

specify the base. It is not good practice to supply fx as numeric (this may not

even be allowed in future versions) since this

can result in errors (if the exchange rate is given the wrong way round (human error))

and it does not preserve AD or any FX sensitivities. base is never inferred from the

fx object.

In [12]: irs.npv(fx=fxr) # USD is Instrument's base, (even though GBP is fx's base)

Out[12]: <Dual: 330.405115, (curve1, curve0), [-514447.8, 494200.3]>

In [13]: irs.npv(fx=fxr, base="gbp") # GBP is explicitly specified

Out[13]: <Dual: 264.324092, (curve1, curve0, fx_gbpusd), [-411558.2, 395360.2, -211.5]>

In [14]: irs.npv(fx=fxr, base=fxr.base) # GBP is explicitly specified and is fx's base currency

Out[14]: <Dual: 264.324092, (curve1, curve0, fx_gbpusd), [-411558.2, 395360.2, -211.5]>

In [15]: irs.npv(solver=solver, base="gbp") # GBP is explicitly specified

Out[15]: <Dual: 264.324092, (curve1, curve0, fx_gbpusd), [-411558.2, 395360.2, -211.5]>

Multi-currency Instruments rely on an FXForwards object to value correctly,

in which case that will be supplied either via solver or via the fx argument. The fx

argument takes priority.

How curves, vol, solver and Instruments interact?#

The pricing mechanisms in rateslib require Instruments and

Curves (and volatility Instruments require a Volatility object)

. FX objects

(usually FXForwards) may also be required

(for multi-currency instruments), and these

are all often interdependent and calibrated by a Solver.

Since Instruments are separate objects to Curves/Vol objects and Solvers, when pricing them it requires a mapping to link them all together. In this section only Curves are discussed but the same features are also applied to Vol objects for those specific Instruments. This leads to…

Three different modes of initialising an Instrument:

Dynamic - Price Time Mapping: this means an Instrument is initialised without any

curvesand these must be provided later at price time, usually inside a function call.In [16]: instrument = IRS(dt(2022, 1, 1), "10Y", "A", fixed_rate=2.5) In [17]: curve = Curve({dt(2022, 1, 1): 1.0, dt(2032, 1, 1): 0.85}) In [18]: instrument.npv(curves=curve) Out[18]: -82171.0416611523 In [19]: instrument.rate(curves=curve) Out[19]: 1.6151376354769176

Explicit - Immediate Mapping: this means an Instrument is initialised with

curvesand this object will be used if no Curves are provided at price time. The Curves must already exist when initialising the Instrument.In [20]: curve = Curve({dt(2022, 1, 1): 1.0, dt(2032, 1, 1): 0.85}) In [21]: instrument = IRS(dt(2022, 1, 1), "10Y", "A", fixed_rate=2.5, curves=curve) In [22]: instrument.npv() Out[22]: -82171.0416611523 In [23]: instrument.rate() Out[23]: 1.6151376354769176

Indirect - String

idMapping: this means an Instrument is initialised withcurvesthat contain lookup information to collect the Curves at price time from asolver.In [24]: instrument = IRS(dt(2022, 1, 1), "10Y", "A", fixed_rate=2.5, curves="curve-id") In [25]: curve = Curve({dt(2022, 1, 1): 1.0, dt(2032, 1, 1): 0.85}, id="curve-id") In [26]: solver = Solver( ....: curves=[curve], ....: instruments=[IRS(dt(2022, 1, 1), "10Y", "A", curves=curve)], ....: s=[1.6151376354769178] ....: ) ....: SUCCESS: `func_tol` reached after 0 iterations (levenberg_marquardt), `f_val`: 1.779867417404908e-29, `time`: 0.0009s In [27]: instrument.npv(solver=solver) Out[27]: <Dual: -82171.041661, (curve-id1, curve-id0), [-1146523.3, 892373.8]> In [28]: instrument.rate(solver=solver) Out[28]: <Dual: 1.615138, (curve-id1, curve-id0), [-11.8, 10.0]>

Then, for price time, this then also leads to the following cases…

Two modes of pricing an Instrument:

Direct Curves Override: if

curvesare given dynamically these are used regardless of which initialisation mode was used for the Instrument.In [29]: curve = Curve({dt(2022, 1, 1): 1.0, dt(2032, 1, 1): 0.85}) In [30]: irs = IRS(dt(2022, 1, 1), "10Y", "A", curves=curve) In [31]: other_curve = Curve({dt(2022, 1, 1): 1.0, dt(2032, 1, 1): 0.85}) In [32]: irs.npv(curves=other_curve) # other_curve overrides the initialised curve Out[32]: 0.0 In [33]: irs.rate(curves=other_curve) # other_curve overrides the initialised curve Out[33]: 1.6151376354769176

With Default Initialisation: if

curvesat price time are not provided then those specified at initialisation are used.As Objects: if Curves were specified these are used directly (see 2. above)

From String id with Solver: if

curvesare not objects, but strings, then asolvermust be supplied to extract the Curves from (see 3. above).

In the unusual combination that curves are given directly in combination with a solver,

and those curves do not form part of the solver’s curve collection, then depending upon the

rateslib options configured, then errors or warnings might be raised or this might be ignored.

What is best practice?#

Amongst the variety of input pricing methods there is a recommended way of working.

This is to use method 3) and to initialise Instruments with a defined curves argument

as string id s. This does not

impede dynamic pricing if curves are constructed and supplied later directly to

pricing methods.

The curves attribute on the Instrument is instructive of its pricing intent.

In [34]: irs = IRS(

....: effective=dt(2022, 1, 1),

....: termination="6m",

....: frequency="Q",

....: currency="usd",

....: notional=500e6,

....: fixed_rate=2.0,

....: curves="sofr", # or ["sofr", "sofr"] for forecasting and discounting

....: )

....:

In [35]: irs.kwargs.meta["curves"]

Out[35]: <rateslib.instruments.protocols.pricing._Curves at 0x16510b650>

At any point a Curve could be constructed and used for dynamic pricing, even if

its id does not match the instrument initialisation. This is usually used in sampling or

scenario analysis.

In [36]: curve = Curve(

....: nodes={dt(2022, 1, 1): 1.0, dt(2023, 1, 1): 0.98},

....: id="not_sofr"

....: )

....:

In [37]: irs.rate(curves=curve)

Out[37]: 1.9975948370062162

Why is this best practice?#

The reasons that this is best practice are:

It provides more flexibility when working with multiple different curve models and multiple

Solvers. Instruments do not need to be re-initialised just to extract alternate valuations or alternate risk sensitivities.It provides more flexibility since only Instruments constructed in this manner can be directly added to the

Portfolioclass. It also extends theSpreadandFlyclasses to allow Instruments which do not share the same Curves.It removes the need to externally keep track of the necessary pricing curves needed for each instrument created, which is often four curves for two legs.

It creates redundancy by avoiding programmatic errors when curves are overwritten and object oriented associations are silently broken, which can occur when using the other methods.

It is anticipated that this mechanism is the one most future proofed when rateslib is extended for server-client-api transfer via JSON or otherwise.

Multiple curve model Solvers#

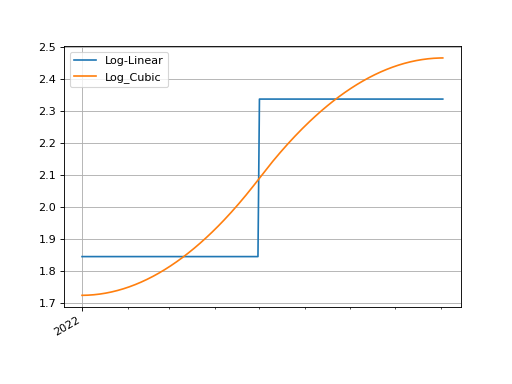

Consider two different curve models, a log-linear one and a log-cubic spline, which we calibrate with the same instruments.

In [38]: instruments = [

....: IRS(dt(2022, 1, 1), "4m", "Q", curves="sofr"),

....: IRS(dt(2022, 1, 1), "8m", "Q", curves="sofr"),

....: ]

....:

In [39]: s = [1.85, 2.10]

In [40]: ll_curve = Curve(

....: nodes={

....: dt(2022, 1, 1): 1.0,

....: dt(2022, 5, 1): 1.0,

....: dt(2022, 9, 3): 1.0

....: },

....: interpolation="log_linear",

....: id="sofr"

....: )

....:

In [41]: lc_curve = Curve(

....: nodes={

....: dt(2022, 1, 1): 1.0,

....: dt(2022, 5, 1): 1.0,

....: dt(2022, 9, 3): 1.0

....: },

....: t=[dt(2022, 1, 1), dt(2022, 1, 1), dt(2022, 1, 1), dt(2022, 1, 1),

....: dt(2022, 5, 1),

....: dt(2022, 9, 3), dt(2022, 9, 3), dt(2022, 9, 3), dt(2022, 9, 3)],

....: id="sofr",

....: )

....:

In [42]: ll_solver = Solver(curves=[ll_curve], instruments=instruments, s=s, instrument_labels=["4m", "8m"], id="sofr")

SUCCESS: `func_tol` reached after 3 iterations (levenberg_marquardt), `f_val`: 1.068776891887703e-16, `time`: 0.0016s

In [43]: lc_solver = Solver(curves=[lc_curve], instruments=instruments, s=s, instrument_labels=["4m", "8m"], id="sofr")

SUCCESS: `func_tol` reached after 3 iterations (levenberg_marquardt), `f_val`: 1.271194837159728e-16, `time`: 0.0014s

In [44]: ll_curve.plot("1D", comparators=[lc_curve], labels=["LL Curve", "LC Curve"])

Out[44]:

(<Figure size 640x480 with 1 Axes>,

<Axes: >,

[<matplotlib.lines.Line2D at 0x16b680c20>,

<matplotlib.lines.Line2D at 0x16b6812b0>])

(Source code, png, hires.png, pdf)

Since the irs instrument was initialised indirectly with string id s we can

supply the Solver s as pricing parameters and the curves named “sofr” in each

of them will be looked up and used to price the irs.

In [45]: irs.rate(solver=ll_solver)

Out[45]: <Dual: 2.017016, (sofr0, sofr1, sofr2), [200.1, -103.5, -98.7]>

In [46]: irs.rate(solver=lc_solver)

Out[46]: <Dual: 1.984736, (sofr0, sofr1, sofr2), [220.2, -143.1, -79.1]>

The Dual datatypes already hint at different risk sensitivities

of the instrument under the different curve model solvers. For good order we can

display the delta risks.

In [47]: irs.delta(solver=ll_solver)

Out[47]:

local_ccy usd

display_ccy usd

type solver label

instruments sofr 4m 8341.36

8m 16622.06

In [48]: irs.delta(solver=lc_solver)

Out[48]:

local_ccy usd

display_ccy usd

type solver label

instruments sofr 4m 11573.70

8m 13397.65

The programmatic errors avoided are as follows:

In [49]: try:

....: irs.delta(curves=ll_curve, solver=lc_solver)

....: except Exception as e:

....: print(e)

....:

A curve has been supplied, as part of ``curves``, which has the same `id` ('sofr'),

as one of the curves available as part of the Solver's collection but is not the same object.

This is ambiguous and cannot price.

Either refactor the arguments as follows:

1) remove the conflicting curve: [curves=[..], solver=<Solver>] -> [curves=None, solver=<Solver>]

2) change the `id` of the supplied curve and ensure the rateslib.defaults option 'curve_not_in_solver' is set to 'ignore'.

This will remove the ability to accurately price risk metrics.

Using a Portfolio#

We can consider creating another Solver for the ESTR curve which extends the SOFR

solver.

In [50]: instruments = [

....: IRS(dt(2022, 1, 1), "3m", "Q", curves="estr"),

....: IRS(dt(2022, 1, 1), "9m", "Q", curves="estr"),

....: ]

....:

In [51]: s = [0.75, 1.65]

In [52]: ll_curve = Curve(

....: nodes={

....: dt(2022, 1, 1): 1.0,

....: dt(2022, 4, 1): 1.0,

....: dt(2022, 10, 1): 1.0

....: },

....: interpolation="log_linear",

....: id="estr",

....: )

....:

In [53]: combined_solver = Solver(

....: curves=[ll_curve],

....: instruments=instruments,

....: s=s,

....: instrument_labels=["3m", "9m"],

....: pre_solvers=[ll_solver],

....: id="estr"

....: )

....:

SUCCESS: `func_tol` reached after 3 iterations (levenberg_marquardt), `f_val`: 1.237437454417223e-15, `time`: 0.0013s

Now we create another IRS and add it to a

Portfolio

In [54]: irs2 = IRS(

....: effective=dt(2022, 1, 1),

....: termination="6m",

....: frequency="Q",

....: currency="eur",

....: notional=-300e6,

....: fixed_rate=1.0,

....: curves="estr",

....: )

....:

In [55]: pf = Portfolio([irs, irs2])

In [56]: pf.npv(solver=combined_solver, local=True)

Out[56]:

{'usd': <Dual: 42456.377860, (sofr0, sofr1, sofr2), [499326346.8, -258138138.0, -246219539.0]>,

'eur': <Dual: -638082.239972, (estr0, estr1, estr2), [-299965158.7, 151143418.5, 150334069.1]>}

In [57]: pf.delta(solver=combined_solver)

Out[57]:

local_ccy eur usd

display_ccy eur usd

type solver label

instruments sofr 4m 0.00 8341.36

8m -0.00 16622.06

estr 3m -3741.35 0.00

9m -11247.59 -0.00

In [58]: pf.gamma(solver=combined_solver)

Out[58]:

type instruments

solver sofr estr

label 4m 8m 3m 9m

local_ccy display_ccy type solver label

eur eur instruments sofr 4m 0.00 0.00 0.00 0.00

8m 0.00 0.00 0.00 0.00

estr 3m 0.00 0.00 0.14 0.28

9m 0.00 0.00 0.28 0.44

usd usd instruments sofr 4m -0.32 -0.50 0.00 0.00

8m -0.50 -0.52 0.00 0.00

estr 3m 0.00 0.00 0.00 0.00

9m 0.00 0.00 0.00 0.00

Warnings#

Silently breaking object associations#

Warning

There is no redundancy for breaking object oriented associations when an

Instrument is initialised with curves as objects.

When an Instrument is created with a direct object

association to Curves which have already been constructed. These will then be

used by default when pricing.

In [59]: curve = Curve({dt(2022, 1, 1): 1.0, dt(2023, 1, 1): 0.98})

In [60]: irs = IRS(dt(2022, 1, 1), "6m", "Q", currency="usd", fixed_rate=2.0, curves=curve)

In [61]: irs.rate()

Out[61]: 1.9975948370062162

In [62]: irs.npv()

Out[62]: -12.0008132132225

If the object is overwritten, or is recreated (say, as a new Curve) the results

will not be as expected.

In [63]: curve = "bad_object" # overwrite the curve variable but the object still exists.

In [64]: irs.rate()

Out[64]: 1.9975948370062162

It is required to update objects instead of recreating them. The documentation

for FXForwards.update() also elaborates

on this point.

Disassociated objects#

Warning

Combining curves and solver that are not associated is bad practice. There

are options for trying to avoid this behaviour.

Consider the below example, which includes two Curve s

and a Solver.

One Curve, labelled “ibor”, is independent, the other,

labelled “rfr”, is associated with the Solver, since it has

been iteratively solved.

In [65]: rfr_curve = Curve({dt(2022, 1, 1): 1.0, dt(2023, 1, 1): 0.98}, id="rfr")

In [66]: ibor_curve = Curve({dt(2022, 1, 1): 1.0, dt(2023, 1, 1): 0.97}, id="ibor")

In [67]: solver = Solver(

....: curves=[rfr_curve],

....: instruments=[(Value(dt(2023, 1, 1)), {"curves": "rfr"})],

....: s=[0.9825]

....: )

....:

SUCCESS: `func_tol` reached after 8 iterations (levenberg_marquardt), `f_val`: 2.3630340650323354e-14, `time`: 0.0006s

When the option curve_not_in_solver is set to “ignore” the independent

Curve and a disassociated Solver

can be provided to a pricing method and the output returns. It uses the curve and,

effectively, ignores the disassociated solver.

In [68]: irs = IRS(dt(2022, 1, 1), dt(2023, 1, 1), "A")

In [69]: defaults.curve_not_in_solver = "ignore"

In [70]: irs.rate(curves=ibor_curve, solver=solver)

Out[70]: 3.050416607823765

In the above the solver is not used for pricing, since it is decoupled from

ibor_curve. It is technically an error to list it as an argument.

Setting the option to “warn” or “raise” enforces a UserWarning or a

ValueError when this behaviour is detected.

In [71]: defaults.curve_not_in_solver = "raise"

In [72]: try:

....: irs.rate(curves=ibor_curve, solver=solver)

....: except Exception as e:

....: print(e)

....:

`curve` must be in `solver`.

When referencing objects by id s this becomes immediately apparent since, the

below will always fail regardless of the configurable option (the solver does not

contain the requested curve and therefore cannot fulfill the request).

In [73]: defaults.curve_not_in_solver = "ignore"

In [74]: try:

....: irs.rate(curves="ibor", solver=solver)

....: except Exception as e:

....: print(e)

....:

'ibor'